7 Ways to Measure Customer Lifetime Value

Would you give your love to someone you’d only met once? Or to someone with whom you’d gone on so many dates, or spent so much time with?

The best customers are the ones who keep coming back, and to help you figure out who your best customers are (so you can give them the love they deserve) you measure Customer Lifetime Value or LTV.

In this post, we’ll take a look at what LTV is and the 7 metrics for LTV calculation. But more importantly, we’ll also talk about

- Why keeping track of LTV is essential

- How you can apply the insights you can gain from tracking LTV

- How you can improve the LTV of your existing customers.

Because when you win your customers’ love, it could well be the kind of love that lasts for a lifetime—which means an entire lifetime of profitability for your business.

And that’s why NEO360 makes it a point to study the granular data involved in LTV calculation. LTV allows us to determine the best ways for allocating your marketing budget for each quarter or year, i.e. for showing a little extra TLC for customers who’ve earned it.

What is LTV?

Very simply, Customer Lifetime Value is how much (monetary) value a single customer brings to your business over his or her entire relationship with your business. A customer that buys from your business once is therefore going to have a much lower LTV than a customer that keeps on buying from you year in and year out.

LTV can either be retroactive or predictive. This means you can either look at a customer’s past purchasing behaviour and calculate his LTV from there, or extrapolate based on past data to figure out how much a customer could potentially be worth down the road.

When you calculate how much all your customers are worth (versus just one customer), or combine all of your customers’ LTV’s, that’s called customer equity (which is something of a misnomer, we know, but that’s what it’s called in marketing-speak, anyway).

7 Metrics for Calculating LTV

There are many ways of calculating the lifetime value of your customers, but below are 7 metrics you can use to calculate LTV using Google Analytics. Now these metrics aren’t universal, meaning some businesses will find some of them more helpful than others. It’ll be up to you to figure out which metrics will be of more use to you.

As examples where applicable, we’ve taken screenshots from the analytics of a website we’ve been working on for one of our retained clients for the last few years. Note that this website is neither a news site or a site that’s swimming in content (in fact, the site is rather on the small side).

1. App Views

This one’s pretty straightforward: app views per user will tell you how many people viewed your app over time, which is something you’ll want to know if your business is tied up with an app.

2. Goal Completions

The goals you set will depend on the kind of business you have. If you have an e-commerce website, for instance, your goals will be different from a site that has a lot of blog posts that encourages people to keep reading or get in touch. Once you’ve figured out what your objectives are, you can start to keep tabs on the goal completions per user.

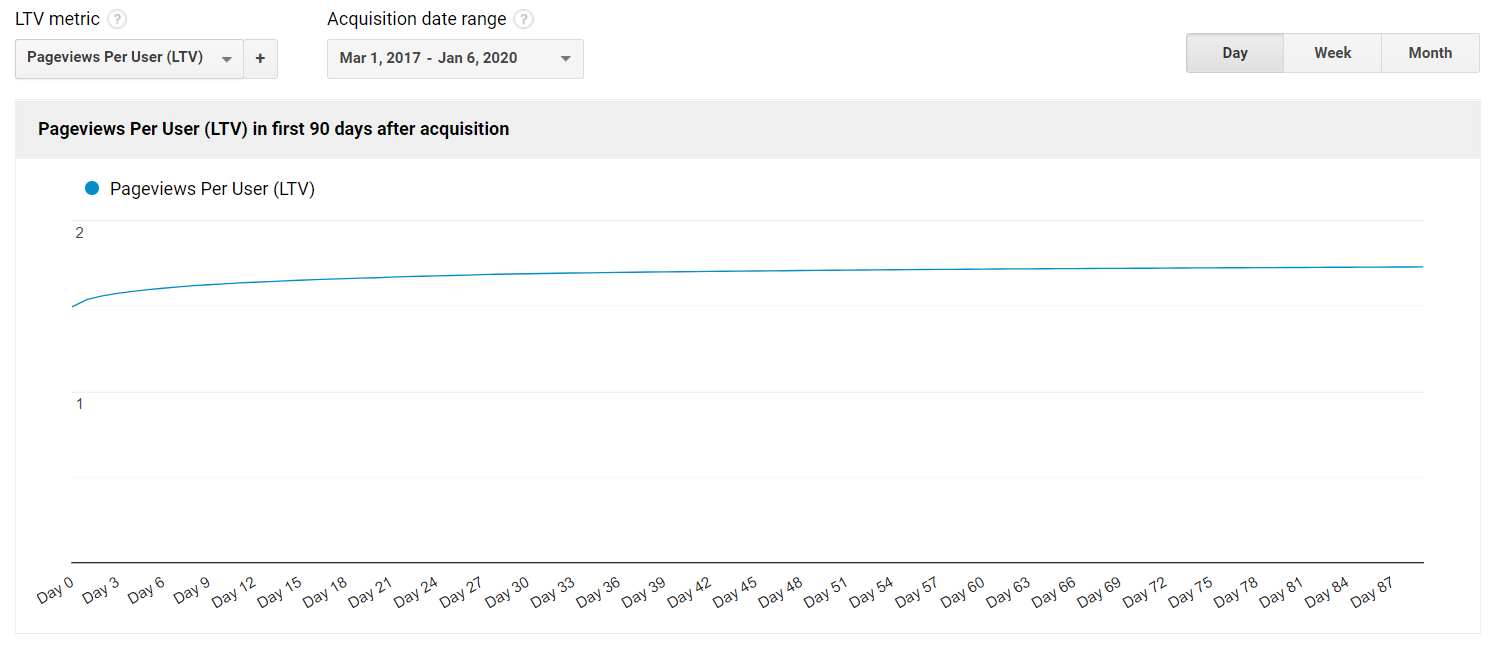

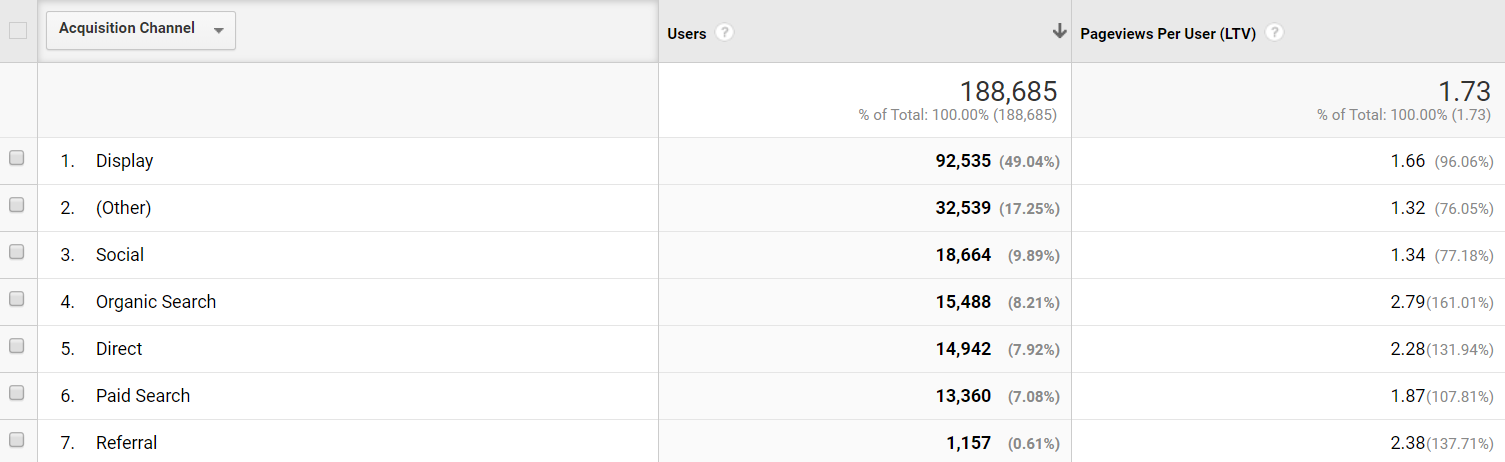

3. Page Views

If your site does happen to be one with a lot of blog posts, then page views per user will be a great help in calculating LTV. It stands to reason that if someone reads a great many posts or pages on your site, that person is more likely to convert and eventually become a (hopefully repeat) customer.

4. Revenue

Now if your site is an e-commerce one, you’re going to want to track revenue per user. This one’s pretty straightforward, too, once you’ve set up your e-commerce features in your analytics and you want to figure out how much income is generated by your website.

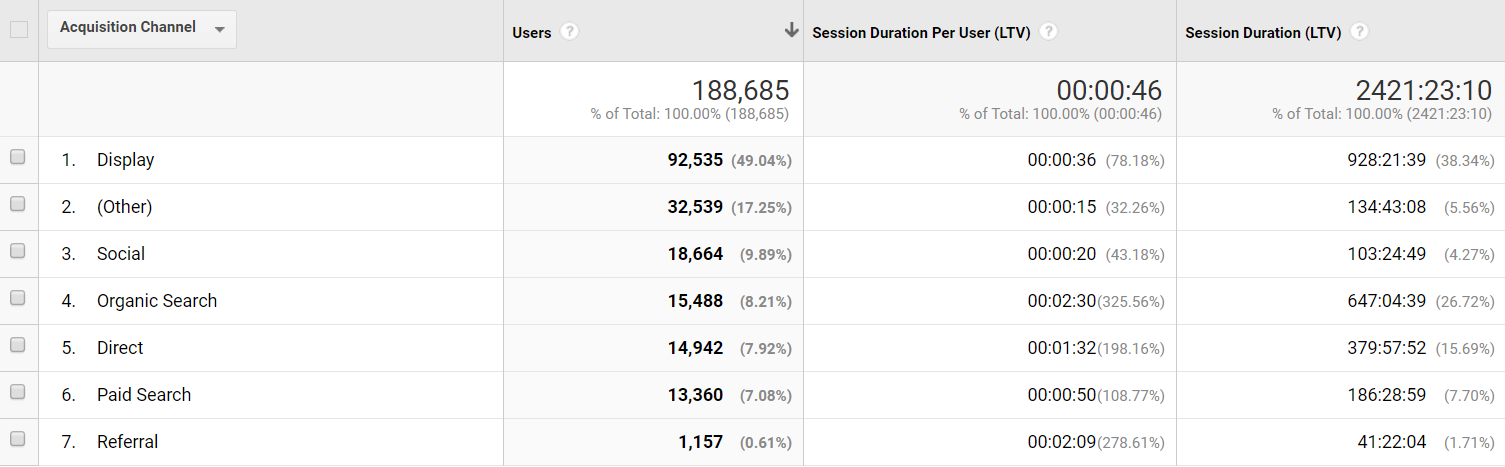

5. Session Duration

Session Duration (right-most column) is measured in seconds.

A session lasts for as long as there is continued activity.

This metric might be of interest to owners of all sorts of sites, because of the way session duration per user tells you how much time a customer spends engaging with a page. Throw a party if you see the numbers going up here, because research shows that people who are more engaged are more likely to, again, convert and fall in love with your business.

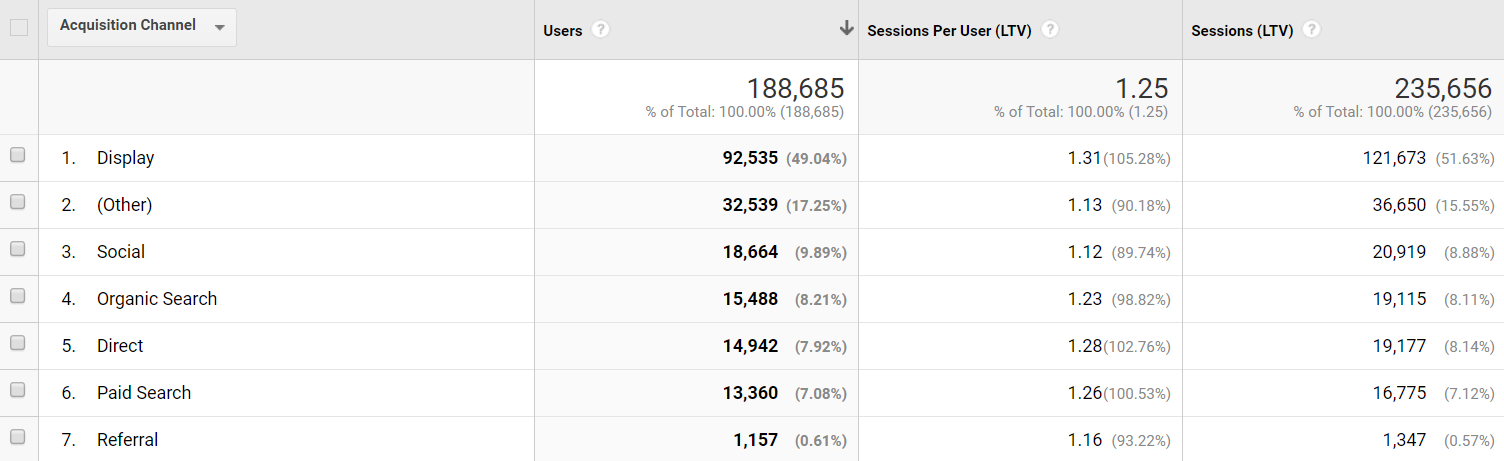

6. Sessions

Total number of Sessions (right-most column) within the date range.

A session is the period of time a user is actively engaged with your website, app, etc.

All usage data (Screen Views, Events, E-commerce, etc.) is associated with a session.

If the previous metric talks about how long someone spent on your site, sessions per user tells you how many times the person visited. More and more visits are an indication that the person can’t get enough of your website (and hopefully, won’t be able to get enough of your products or services).

7. Transactions

This last metric ties in with the first and/or fourth metric and is, again, pretty straightforward. You can expect your transactions per user to align with your site’s conversion rate.

Why is LTV so important?

Just like “the customer is always right” and “under-commit and over-deliver”, a tried-and-true piece of marketing wisdom is knowing how much more expensive it is to get new customers.

The practical application of these words of wisdom would therefore be to take very, very good care of the customers you already have—so they can take care of you in return by staying loyal to your business.

As explained in the video below, most marketers stop at acquiring and closing customers and leave it to customer service to take care of existing customers, when in fact, it’s these customers who are more than likely to buy again.

Keeping track of Customer Lifetime Value not only makes it possible, but easier for you to not just figure out who your best customers are, but keep them for the long term.

Check out these numbers from Clevertap which show just how important tracking your LTV can be:

- A 5% increase in retention produces a 25% increase in profit (Bain & Company)

- Acquiring a new customer is between 5x and 25x more expensive than retaining an existing customer (Harvard Business Review)

- The probability of converting an existing customer is between 60 to 70% (SignalMind)

- Existing customers spend 67% more on average than new customers (Business.com)

- 76% of companies see CLV as an important concept for their organisation (Invesp)

When used in its predictive capacity, LTV can also be a great help in forecasting how much revenue you can reasonably expect from certain customers, which in turn can help you in your planning. By planning, we mean developing strategies for getting new customers while nurturing your existing customer base.

How do you use LTV relative to other metrics?

Obviously, Customer Lifetime Value isn’t the only thing you need to keep an eye on, but there are certain other metrics that you probably already track which, when used in conjunction with LTV, can help inform your marketing decision making.

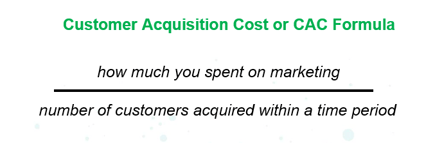

One such metric is Customer Acquisition Cost or CAC, which is similar to (but not the same as) Cost Per Acquisition or CPA. CAC refers to how much it costs a business to get a customer, overall, while CPA refers to how much it costs to get a lead within a single campaign.

Very simply, CAC is calculated by:

But when you break down everything that goes into a business’ marketing budget, you’ll find that calculating CAC is anything but simple. Different marketing aspects perform at different levels or speed (e.g. SEO vs Paid Search), so just lumping all your marketing expenditures together to figure out how much your CAC is won’t give you a very accurate figure.

The best thing you can do is to group similar marketing efforts together according to their nature or performance and figure out the CAC from there. That way you’ll see how effective each group (of channels or platforms) is in bringing in customers.

But even when you have your CAC, you’ll only get an incomplete picture of how much it costs to get a customer because you won’t see whether that customer you acquired was worth what you put in to acquire him. And that’s where LTV comes in, and why LTV and CAC are often expressed as a ratio.

LTV can tell you how long it will take for you to get a return on your investment into acquiring that customer. Say a customer you spent 10 dollars to acquire ended up spending 300 dollars on your products or services over the three years he’s been buying from you. Not too shabby, that CAC and LTV.

The beauty of looking at your data from an LTV perspective is it encourages you to move away from stopping at calculating average purchase value, and to move on towards segmentation. You’ll find yourself taking a long, hard look at who your loyal customers really are, and focusing more on them rather than the one-time buyers (or those who never converted at all).

That means, when you calculate CAC based on your best customers (instead of all of them lumped together), you’ll have a much clearer idea of how much you need to spend to acquire high quality or high loyalty customers.

Do note, however, that it is possible to use LTV itself, incorrectly, as in the case, for example, of customers being segmented inaccurately. It’s also possible to focus so much on existing customers that potential customers end up getting relatively neglected.

Also note that you can also use LTV metrics for testing things like landing pages or gauging how well a particular promotional effort is working out.

Other metrics you can use that are relative to LTV include Customer Growth (or how many new customers came in during a specified time frame), Revenue Growth, and Customer Attrition (AKA Customer Churn, or how many customers you’ve lost).

How can you improve LTV?

Or, put another (if more direct) way, how can you increase the value that an existing customer brings into your business? After all, Customer Lifetime Value is reflected by metrics, so it’s only natural for you to want to boost these numbers—and there are ways to make that happen using digital marketing.

- Retargeting. If someone visits your website and doesn’t convert (or does, e.g. downloads your free e-book or subscribes to your newsletter but hasn’t actually bought anything), retargeting gives you a way to reach out to this person again to try and encourage an actual purchase.

- Leveraging social media. There’s a good chance that people who patronise your products also follow you on social media, which opens up opportunities for you to keep in touch and nurture your customer relationships.

- Optimising UX. If you want customers to keep on coming back, you’d better make sure your website works without a hitch. You can’t reasonably expect someone to come and buy from you again if the navigation is too complicated or something doesn’t work. Your site has to look great and work as great as it looks.

- Marketing Automation. Don’t underestimate the power of marketing automation in your digital marketing. Use emails to say thank you after customers make a purchase (which could be the “beginning of a beautiful friendship”), and to say hello again to customers who haven’t bought from you for some time (and who might buy again).

When using emails, it’s an absolute must to keep your email lists clean, and to make sure they’re segmented correctly according to the buyer’s journey. That way, you can make sure your customers (existing or potential) get what they need, when they need it, and in so doing, boost their LTV.

Ready to build real customer relationships that last a lifetime? Get in touch with a team that stays on top of the data that shows you how.